Business Year 2023

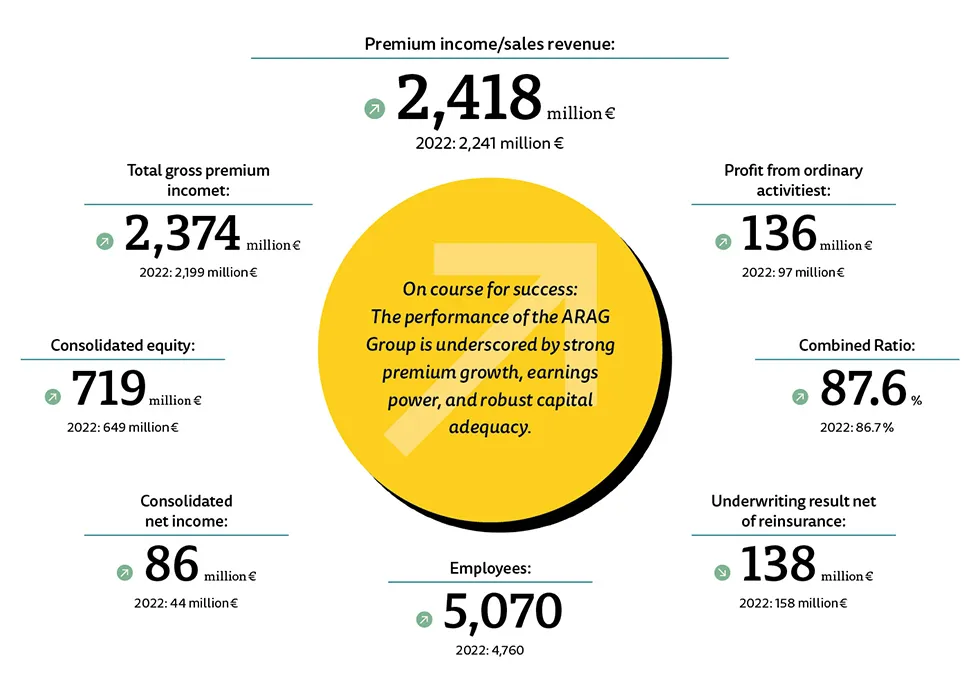

The ARAG Group increased its gross premium income in 2023 by 7.9 percent from €2.2 billion to €2.37 billion. Consolidated turnover – including revenue from service companies – came to €2.42 billion. The underwriting result totaled €137.6 million. At €136.5 million, the income from ordinary activities was significantly higher than in the previous year (€97.3 million).

The numbers speak for themselves. The steady growth achieved in past years provides us a solid foundation for future success.